Business Insurance in and around Billings

One of the top small business insurance companies in Billings, and beyond.

Cover all the bases for your small business

Insure The Business You've Built.

Running a small business is no joke. Getting the right insurance should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, trades, retailers and more!

One of the top small business insurance companies in Billings, and beyond.

Cover all the bases for your small business

Keep Your Business Secure

When one is as committed to their small business as you are, it is understandable to want to make sure everything has been thought of. That's why State Farm has coverage options for commercial auto, worker’s compensation, business owners policies, and more.

The right coverages can help keep your business safe. Consider stopping by State Farm agent Karen Smith's office today to discuss your options and get started!

Simple Insights®

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

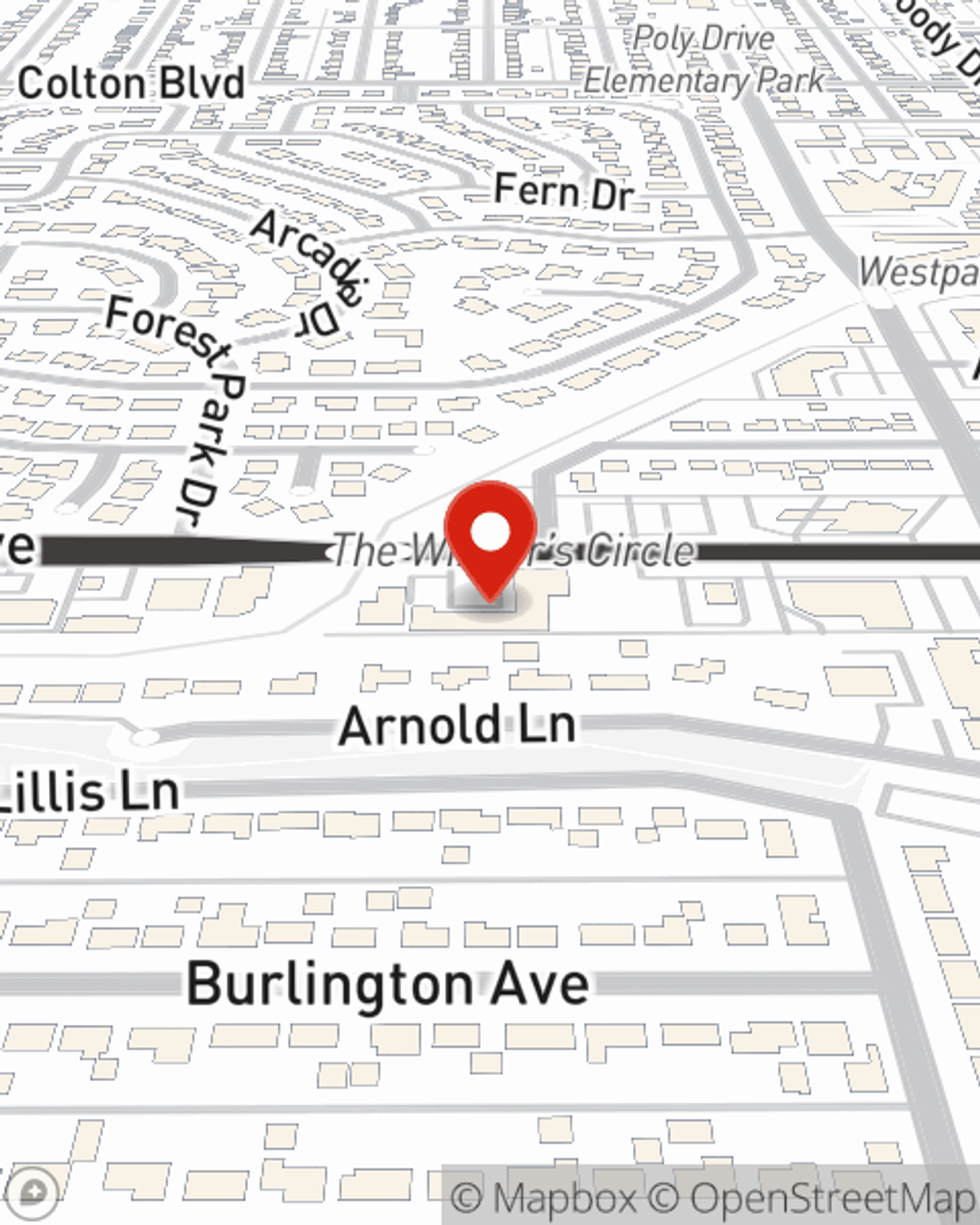

Karen Smith

State Farm® Insurance AgentSimple Insights®

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.